Bali now requires a tourist tax for all international visitors, introduced to support cultural preservation and environmental protection across the island. Before your trip, it’s important to understand how the tax works, how to pay it, and who is exempt. This guide covers everything you need to ensure a smooth arrival in Bali.

What is the Bali Tourist Tax?

The Bali tourist tax, officially known as the Tourist Levy for Foreign Tourists, is a mandatory fee for non-Indonesian travelers entering Bali. The regulation is part of Bali Province Regional Regulation Number 6 of 2023 and is managed through the official government platform, Love Bali website.

Key Details

-

Amount: The fee is IDR 150.000 per person.

(approximately USD 10, AUD 15, or EUR 9). - Start date: Implemented on February 14, 2024.

- Frequency: This is a one-time fee upon entry to Bali (not per night).

- Who must pay: All international visitors entering Bali, regardless of age.

How to Pay the Bali Tourist Tax

You can pay the tax online before arrival or at the airport/harbor. Paying online is highly recommended to avoid queues.

1. Online Payment (Recommended)

Paying online before you fly is the fastest and easiest method.

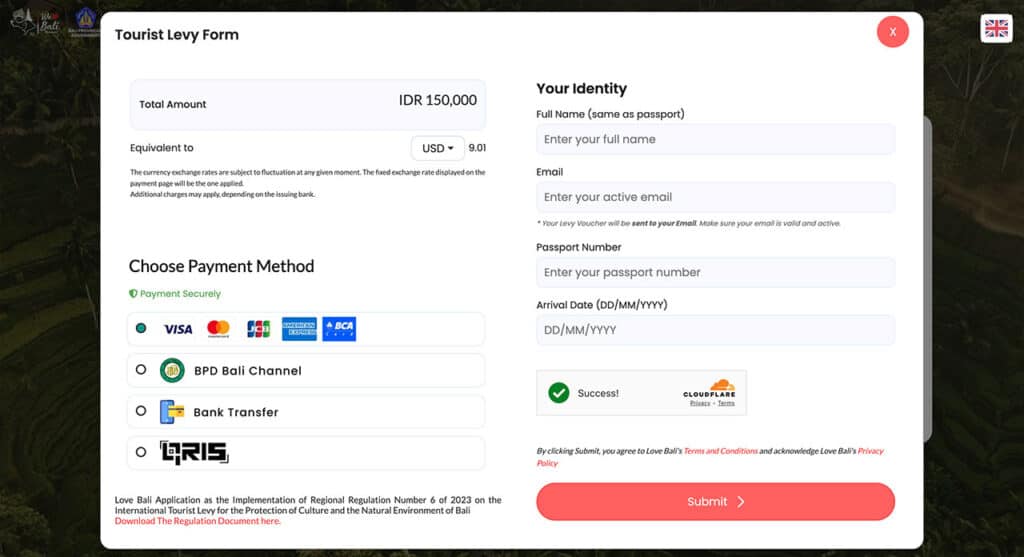

- Visit the Bali tourist tax official website: lovebali.baliprov.go.id.

- Enter your details (name as shown on passport, passport number, email, and arrival date).

- Choose your payment method (Visa, MasterCard, JCB, American Express, QRIS, or bank transfer).

- After payment, you’ll receive a QR code by email. Present this when you arrive in Bali.

Important:

- Pay at least 48 hours before arrival, especially during peak travel seasons.

- If the QR code email doesn’t appear, check your spam or promotions folders.

2. Payment Upon Arrival

If you can’t pay online, payment counters are available at:

- I Gusti Ngurah Rai International Airport (DPS)

- Benoa Harbor

Note that payment at the airport is cashless only. Expect potential waiting times when multiple flights arrive at the same time.

Who is Exempt from the Bali Tourist Tax?

The following groups do not need to pay the levy:

- Holders of KITAS or KITAP.

- Diplomatic Visa holders.

- Airline/ship crew members.

- Family Unification Visa holders.

- Student Visa holders.

- Golden Visa holders.

- Visitors entering Indonesia for non-tourism purposes (based on visa type).

If you qualify for an exemption, you must submit your application through the official website (https://lovebali.baliprov.go.id/exception) no later than five days before your arrival.

Why Does Bali Charge a Tourist Tax?

Revenue collected from the levy supports long-term sustainability initiatives, including:

- Cultural preservation – protecting Balinese traditions, arts, and cultural heritage.

- Environmental conservation – maintaining natural resources and coastal areas.

- Tourism service improvements – enhancing visitor services and facilities.

- Infrastructure upgrades – improving roads, parks, public areas, and transportation.

Your contribution helps ensure Bali remains beautiful and culturally rich for future generations.

Important Things for Travelers

- Keep your QR code ready on your phone or printed for quick scanning.

- If you travel to other Indonesian destinations (e.g., Nusa Penida, Gili Islands, Lombok) and return to Bali without leaving Indonesia, you do not need to pay the tax again.

- Avoid unofficial websites selling “tourist tax services.” Only use the Bali tourist tax official website, lovebali.baliprov.go.id.

- The Bali Tourist Tax is separate from other entry requirements, such as the Indonesian visa and the customs declaration form.

By paying this modest fee, you’re contributing to the preservation of Bali’s unique cultural heritage and natural beauty, ensuring this paradise remains pristine for future generations to enjoy.